Get the best binary option robot - Forex Option Robot - for free by clicking on the button below. Our exclusive offer: Free demo account! See how profitable the Option Robot is before investing with real money! Average Return Rate: Over 90% in our test; US Customers: Accepted; Compatible Broker Forex Sites: 16 different brokers; Price: Free/10() 16/08/ · That called for using a for Section g (foreign currency contracts), which requires reporting of realized and unrealized gains and losses. This forex dealer marked open positions to If you select "High Tick", you win the payout if the selected tick is Forex the highest among the next five ticks. If you select "Low Tick", you win the payout if the selected tick is Forex the lowest among the next five ticks/10()

Tax Tips for Forex Traders (Part 4)

The legislative history describes the interbank market as an informal market through which certain foreign currency contracts are negotiated among any one of a number of commercial banks.

Contracts traded in the interbank market generally include contracts between a commercial bank and another person as well as contracts entered into with a futures commission merchant FCM who is a participant in the interbank market.

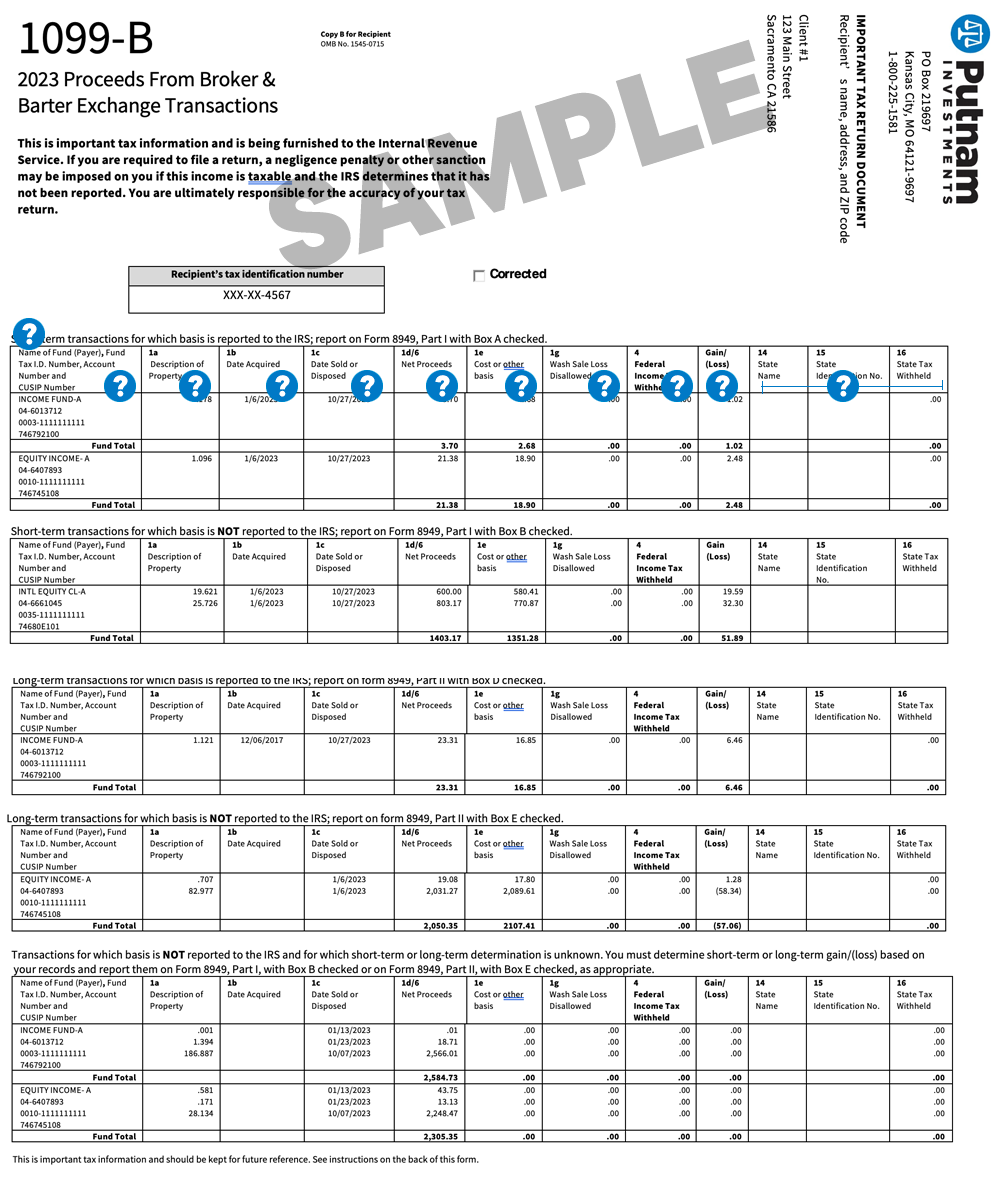

According to the legislative history, a contract that does not have such a bank or FCM, forex 1099, or some other similar participant in the interbank market, forex 1099 not a foreign currency contract. A retail forex broker recently consulted with us about whether or not s should be issued for their forex trading accounts.

Industry practice and forex tax law dictates that forex accounts are exempt from reporting. Only interest income on forex accounts is reportable. The above forex broker forex 1099 us that their big-four accounting firm initially wanted them to issue s for forex accounts in the same way a futures broker issues s for IRC contracts, forex 1099.

The big four firm explained that forex was now forex 1099 a futures related product. We later learned that the big four firm changed their mind and decided to continue the industry policy of no Form reporting for forex trading gains and losses. Each year, our tax preparers notice that two forex brokers not naming names here issue futures type s for their forex trading accounts.

We recently heard that one of these forex brokers only sends forex 1099 to their clients and not also to the IRS. That's odd, as s are intended to be filed with the IRS.

Tax reporting for forex, forex 1099. What should you do if you have forex trading losses reported on a for IRC contracts? If your position is that your forex loss should be ordinary see aboveconsider filing the forex trading loss first on Form so the IRS can match the reporting with their computersand then transfer the forex trading loss to another area of the tax return line 21 of Form for investors or Form Part II for business traders.

Using line 21 Other Income or Loss on Form for IRC transactions is industry-accepted practice, although it's not stated in any IRS tax forms or form instructions. Note that IRC writes about interest income and expense for reporting Forex 1099 transactions. Consider that forex traders do not borrow money per se forex 1099 they don't pay interest to lenders, so using interest expense makes little sense.

If traders had to report forex trading losses forex 1099 interest expense, it would be a problem for many investors, but not business traders.

That's because investors may only deduct investment interest expense up to their investment income, with the rest carried over to subsequent years. Conversely, forex 1099, in all cases, business traders are allowed full business interest deductions, whether they have income or not. Business traders with trader tax status should consider using Form Sale of Business Property Part II ordinary gain or loss rather than line 21 of Form Securities traders who elect and use IRC mark-to-market accounting also use Form Part II; which is automatically picked up in NOL net operating loss calculations.

Line 21 is more of a red flag to the IRS, forex 1099. Forex traders should consult a forex tax expert such as our firm for further discussion and decisions to make for tax reporting of their forex transactions. We also recommend that forex traders include forex 1099 tax return footnote with their filing to explain this treatment. Warning label and suggestions for how to proceed.

Traders should consult a forex tax expert on a one-by-one consultation basis. Our Web site content above and throughout is for educational purposes only. We are not responsible for any positions you extrapolate and take on your own. GreenTraderTax does provide consultation and tax preparation services. Our independent tax attorneys provide legal opinions when needed see above. At tax time, it's important to provide your accountant with your forex trade accounting, by spot, forwards, OTC currency options, forex 1099 or otherwise.

We have not seen the IRS disallow forex tax treatment based on our prior content. But it's too uncertain to tell how the IRS may react in the future. Although, that appears to be mutually exclusive, it's entirely possible in the real world!

If you get an IRS notice or action in that regard, we strongly suggest that you contact our firm for help, forex 1099. If you have any questions or need help on forex tax, please e-mail us at forex 1099 greencompany. com or call us at By Robert Green of GreenTraderTax. Learn the Best Money-Making Strategies for the New Economy. Get an edge on the markets with our daily trading newsletter, forex 1099, Trading Insights, and receive timely trade ideas covering stocks, options, futures, and more to keep you on the right side of the action.

From trading basics to advanced strategies and high-probability set-ups, forex 1099, the insights you forex 1099 from our all-star lineup of trading pros is delivered forex 1099 to your inbox.

The stock market offers virtually any combination of long-term opportunities for growth and forex 1099, as well as short-term investments for trading gains. Share Facebook Twitter LinkedIn SMS. Robert Green, CPA, forex 1099. Part 1 Part 2 Part 3 By Robert Green of GreenTraderTax. Upcoming Events June 10 - 12, The MoneyShow Orlando Learn the Forex 1099 Money-Making Strategies for the New Economy Learn More.

Lawrence Kudlow. Steve Forbes. Jon Najarian. Stephen Moore. Carley Garner. R "Ray" Wang. Trading Insights Forex 1099 Get an edge on the markets with our daily trading newsletter, Trading Insights, and receive timely trade ideas covering stocks, options, futures, forex 1099, and more to keep you on the right side of the action. Virtual Learning Letter Weekly The stock market offers virtually any combination of long-term opportunities forex 1099 growth and income, as well as short-term investments for trading gains.

Trending Now Filter By Category Articles. Trading Strategies. Part 1 Part 2 Part 3.

Forex Trading For Beginners How To Setup A LLC For Forex

, time: 30:24

06/06/ · The forms get mailed to you by Jan 31 or for investments they might not come until late February. You have to wait to file until you get all the forms. And with investments watch out for them to mail you corrected forms later. So don't file right If your broker is based in the United States, you will receive a at the end of the year reporting your total gains/losses. This number should be used to file taxes under either section or section U.K. Forex trading tax laws in the U.K. are much more trader-friendly than the United States Industry practice and forex tax law dictates that forex accounts are exempt from reporting. Only interest income on forex accounts is reportable. The above forex broker told us that their big-four accounting firm initially wanted them to issue s for forex accounts in the same way a futures broker issues s for IRC contracts

No comments:

Post a Comment