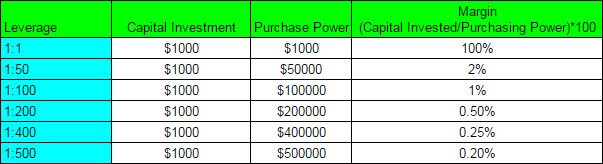

/08/17 · Leverage, which is the use of borrowed money to invest, is very common in forex trading. By borrowing money from a broker, investors can trade larger positions in a currency /05/26 · The usual leverage used by professional forex traders is What this means is that with $ in your account you can control $50K. is the best leverage that you should use. If playback doesn't begin shortly, try restarting your device. Videos you watch may be added to the TV's watch history and influence TV recommendations /07/31 · What is the best leverage to use when trading with a $ Forex account? If you have $ in your account, is a good leverage ratio. This way you will have $ 50, at your disposal

Best Leverage for Forex Trading: What Ratio is Good for Newbies & Pros | LiteForex

If you are a rookie trader, you may find yourself asking questions such as 'what is leverage in Forex trading? In general, leverage enables you to influence your environment in a way that multiplies the outcome of your efforts without increasing your resources. In the world of forex 500 leverage, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing, forex 500 leverage. This gives you the advantage of getting greater returns for a small up-front investment, though it is important to note that forex 500 leverage can be at risk of higher losses.

In finance, it is when you borrow money, to invest and make more money due to your increased buying power. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. Let's look at it in more detail for the finance, Forex tradingand trading world. Leverage in finance pertains to the use of debt to buy assets. This is done in order to avoid using too much equity.

If a company, investment or property is termed as 'highly geared' it means that it has a greater proportion of debt than equity. When this type of debt is used in such a way that the return generated is greater than the interest associated with it, an investor is in a favourable position. However, an excessive amount of margin is risky, given that it is always possible to fail to repay it.

Note that the levels shown in Trades 2 and 3 is available for Professional clients only. A Professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and can properly assess the risks that these incur. Financial and operating margin is quite different from each other, forex 500 leverage, with the latter consisting of a business entity and is calculated as a sum total of the amount of fixed costs it bears, whereby the higher the amount of fixed costs, the higher the operating leverage will be.

So, what does leveraging mean for a business? It forex 500 leverage the use of external funds for expansion, startup or asset acquisition. Businesses can also use leveraged equity to raise funds from existing investors.

Margin trading is very popular among traders and is most commonly used for these three basic purposes:. When the cost of capital debt is low, leveraged equity can increase returns for shareholders. When you own stock or shares in a company that has a significant amount of debt, you have leveraged equity.

Forex 500 leverage, the stockholder experiences the same benefits and costs as using debt. Day trading leverage allows you to control much larger amounts in a trade, forex 500 leverage, with a minimal deposit in your account. Leveraged trading is also known as margin trading.

You can open up a small account with a brokerage, and then essentially borrow money from the broker to open a large position. This allows traders to magnify the amount of profits earned, forex 500 leverage.

Remember, however, that this also magnifies the potential losses. Stock market margin includes trading stocks with only a small amount of trading capital. This is also seen in Forex leveraging, wherein traders are allowed to open positions on currency pairs larger than what they can afford with their account balance alone.

It should be remembered that margin does not alter the profit potential of a trade; but instead, reduces the amount of equity that you use. Margin trading is also considered a double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss, forex 500 leverage. Therefore, it is essential to exercise risk management.

Financial leverage is essentially an account boost for Forex traders. With the help of this construction, a trader can open orders as forex 500 leverage as 1, times greater than their own capital.

In other words, it is a way for traders to gain access to much larger volumes than they would initially be able to forex 500 leverage with. More and more traders are deciding to move into the FX Forex, also known as the Foreign Exchange Market market every day. Trading currencies online is an exciting experience, and is accessible for many traders, and while each person will have their own reasons for trading in this market, the level of financial margin available remains one of the most popular reasons for traders choosing to trade on the FX market.

When visiting sites that are dedicated to trading, it's possible that you're going to see a lot of flashy banners offering something like ''trade with 0.

While each of these terms may not be immediately clear to a beginner, forex 500 leverage request to have Forex leverage explained seems to be the most common one. Many traders define leverage as a credit line that a broker provides to their client. This isn't exactly true, forex 500 leverage, as margin does not have the features that are issued together with credit.

First of all, when you are trading with leverage you are not expected to pay any credit back, forex 500 leverage. You are simply obliged to close your position, or keep it open before it is closed by the margin call. Forex 500 leverage other forex 500 leverage, there is no particular deadline for settling your leverage boost provided by the broker. In addition, there is also no interest on margin, instead, FX Swaps are usually what it takes to transfer your position overnight.

However, unlike regular loans, the swap payments can also be profitable for a trader. To sum up, margin forex 500 leverage is a tool that increases the size of the maximum position that can be opened by a trader. Now we have a better understanding of Forex trading leverage, forex 500 leverage, let's see how it works with an example.

If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts, forex 500 leverage.

Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. Click the banner below to register for FREE trading webinars! Let's say a trader has 1, USD in their trading account. A regular lot of '1' on MetaTrader 4 is equal tocurrency units.

As it is possible to trade mini and even micro lots with Admiral Markets, a deposit forex 500 leverage size would allow a trader to open forex 500 leverage lots 0. This is why many traders decide to employ gearing, also known as financial leverage, in their trading - so that the size of the trading position and profits could be higher. Let's assume a trader with 1, USD in their account balance wants to trade big and their broker is supplying a leverage of This way a trader can open a position that is as large as 5 lots, when it is denominated in USD.

The trader can actually request orders of times the size of their deposit, forex 500 leverage. This way, if leverage is used, forex 500 leverage, a trader would be making USD instead of 1 USD. It is of course important to state that a trader can lose the funds as quickly as it is possible to gain them. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading is.

Admiral Markets offers varying leverages which are dependent on client status via Admiral Markets Pro terms. For retail clients, leverages of up to for currency pairs and for indices are available.

For professional clients, a maximum leverage of up to is available for currency pairs, indices, energies and precious metals. Users can also participate in futures trading leverage on currency, stock and commodity CFDs.

Both retail and professional status come with their own unique benefits and trade-offsso it's a good idea to investigate them fully before trading. Find out today if you're eligible for professional termsso you can maximise your trading potential, and keep your leverage where you want it to be!

It is hard to determine the best level one should use, as it mainly depends on the trader's strategy and the actual vision of upcoming market moves. As a rule of thumb, the longer you expect to keep your position open, the smaller the leverage should be. This would be logical, as long positions are usually opened when large market moves are expected. However, forex 500 leverage, when you are looking for a long lasting position, forex 500 leverage will want to avoid being 'Stopped Out' due to market fluctuations.

In contrast, when a trader opens a position that is expected to last for a few minutes or even seconds, they are mainly aiming to extract the maximum amount of profit within a limited time. What is the best Forex leveraging in this case? Usually, such a person would be aiming to employ high, or in some cases, forex 500 leverage, the highest possible margin to assure the largest profit is realised, while trading small market fluctuations. From this we can see that the margin ratio strongly depends on the strategy that is going to be used.

To give you a better overview, scalpers and breakout traders try to use as high a leverage as possible, as they usually look for quick trades, forex 500 leverage. Positional traders often trade with low leverage or none at forex 500 leverage. A desired leverage for a positional trader usually starts at and goes up to about When scalpingtraders tend to employ a leverage that starts at and may go as forex 500 leverage as Knowing the effect of leveraging and the optimal leverage Forex trading ratio is vital for a successful trading strategyas you never want to overtrade, but you always want to be able to squeeze the maximum out of potentially profitable trades.

Usually a trader is advised to experiment with leverage within their strategy for a while, in order to find the most suitable one. To learn more about why lower leverage is good for retail traders and what is the success rate for high vs. low leverage, watch this free webinar here:. Leverage trading crypto has also become very popular in recent years and many traders use similar strategies trading Forex as they do on trading digital currencies, forex 500 leverage.

Many brokers now offer margin trading on cryptocurrency CFDs. This means traders can speculate on the price direction of a cryptocurrency without owning the underlying asset, storing it and using unregulated crypto exchanges. Bitcoin leverage trading is also possible.

However, when trading crypto markets on margin, the amount offered by brokers is more limited due to the highly volatile forex 500 leverage of cryptocurrencies. With Admiral Markets, retail clients can trade cryptocurrency CFDs like bitcoin with leverage of Unlike futures and stock brokers that offer limited margin or none at all, the offers from FX brokers are much more attractive for traders that are aiming to enjoy the maximum gearing size.

Forex 500 leverage is hard to indicate the size of the margin forex 500 leverage a Forex trader should look for, yet most of the Forex brokers in the marketplace offer margin based trading that is available from on cryptocurrency CFDs, all the way up to However, this also depends on whether or not the broker is a regulated entity or not.

Brokers that are regulated by well-known regulators such as the UK Financial Conduct Authority, forex 500 leverage, the Cyprus Securities and Exchange Commission and the Australian Securities and Investments Commission, offer limited margin to clients categorised as retail. This tends to be an average of for clients categorised as 'retail', forex 500 leverage. There are also many brokers that can supply margin.

Also, forex 500 leverage, in very rare cases it is possible to open an account with a broker that supplies 1, however, there aren't many traders who would actually want to use gearing at this level. Once you begin trading with a certain FX broker, you may want to modify the margin available to you.

This depends on the broker. With Admiral Markets you can use an industry standardised procedure that includes authenticating to the Trader's Roomselecting your account, and changing the leverage available.

This IS WHY Most BEGINNERS Lose Their ACCOUNTS (What Is Leverage?)

, time: 24:32Leverage Forex Brokers For - Forex Rank

Plus account leverage ranges based on the instrument traded ranging from leverage for crypto including bitcoin, for commodities ( for gold) to for forex with each Plus instrument traded having specific leverage that cannot be changed /12/14 · If you have realized anything about forex trading or forex brokers, its that most offer an extreme amount of leverage. It is very common to see leverage of to or even more. Brokers that offer its clients or more leverage can be dangerous to unexperienced traders /03/30 · This way, if leverage is used, a trader would be making USD instead of 1 USD. It is of course important to state that a trader can lose the funds as quickly as it is possible to gain them. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading is

No comments:

Post a Comment