So what does hedging mean in forex? Hedging is simply protecting yourself against a big loss by places both buy and sell trades simultaneously until the move takes off in the direction you were indicating. This is only one way but is also known as direct blogger.comted Reading Time: 5 mins 13/05/ · Hedging in forex is the method of reducing your losses by opening one or more currency trades that offset an existing position. The goal of hedging isn’t necessarily to completely eradicate your risk, but rather to limit it to a known amount 03/02/ · Hedging is meant to reduce the risk of adverse price movements. Even though it can’t prevent feared events from happening, it prepares you to deal with the consequences better. The impact of an adverse event will be reduced, and your losses will be limited to a Estimated Reading Time: 3 mins

What Does Hedging Mean In Forex? -How To Profit With Hedging – Stay At Home Trader

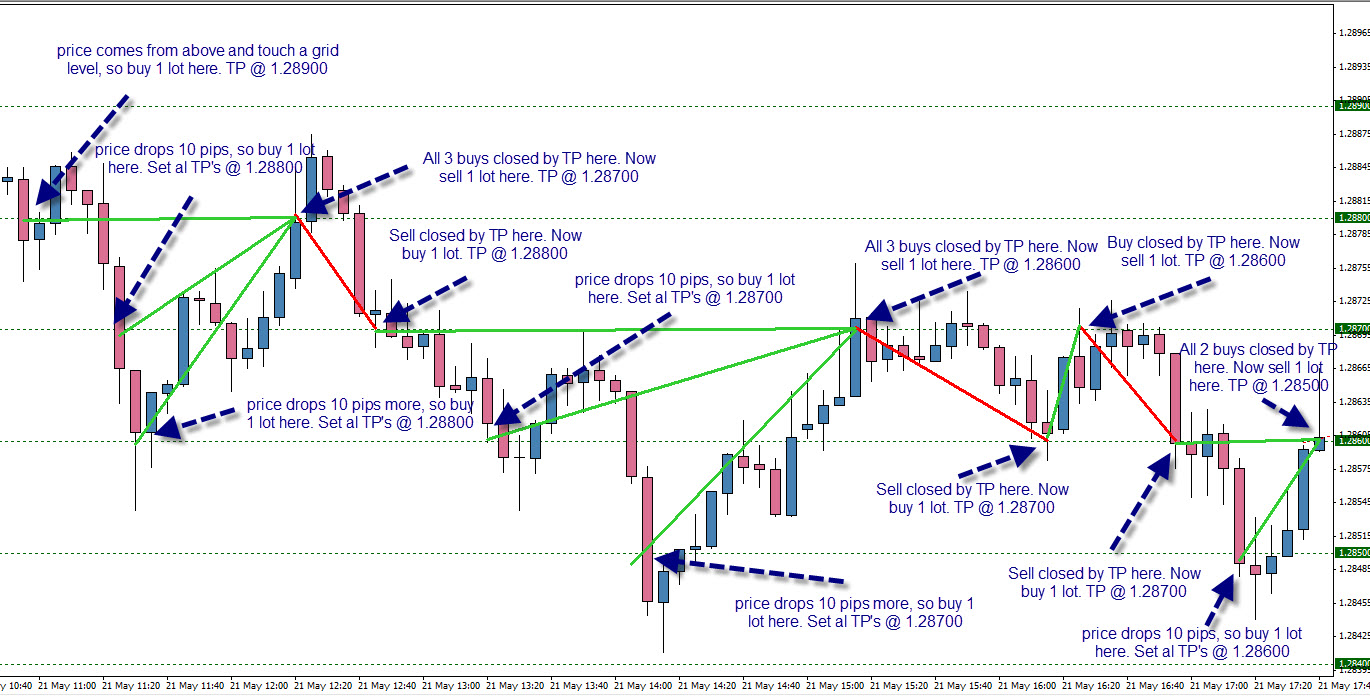

There are many strategies and a lot of power professional traders use hedging. So what does hedging mean in forex? Hedging is simply protecting yourself against a big loss by places both buy and sell trades simultaneously until the move takes off in the direction you were indicating. This is only one way but is also known as direct hedging.

There are a lot of other ways to hedge as well and all can be successful if you want to dig deep into it. There are some areas of the world including the U. that does not allow hedging if you use a regulated broker.

The way we talked about hedging above is simple hedging. So with most all brokers outside the U. Some traders simply do this on a simple support and resistance line because most of the time a trade will do two things reverse or pass and check the support to continue on.

The other thing it might do is consolidate which is basically a no-win situation, what does hedging mean in forex. Once it either takes off or rejects and reverses you close one of the trades.

You do have to time this just right when you go to close a trade and that can take time demoing to get down. Another way of hedging is doing it with different currency pairs. So you could go short on USDCHF and go long on EURUSD. This still exposes you to the CHF and EUR markets that could be completely different or the same what does hedging mean in forex well. Many traders consider hedging a double-edged sword because you can make profit and protect your account at the same time.

If you have taken a number of forex trades you can see that sometimes you are in profit right away and all goes well. Other times you place a trade right when all confirmations line up and it does exactly the opposite.

Both of these cases hedging can help what does hedging mean in forex if it is done right. So take your time work your way up to this if you are just starting out and you will be just fine.

Hedging in the new paradigm of trading is different. There is going to be what is call pullbacks, what does hedging mean in forex.

Those pullbacks can and will cut into your profits at times. You are pretty much just riding the waves. A lot of big moves will have tons of pullbacks and this is where you can take advantage of precise entries and make X the amount of old paradigm traders. I am not trying to see just placing what does hedging mean in forex long term trade and letting it right to a certain take profit point is bad.

I will also look to take those trades as well just depending on my schedule and what I have going on for the week. But if you have the time you can make a lot more pips on the pullbacks which builds your ROI that much quicker so why not, what does hedging mean in forex. If this is overwhelming that is okay as I stated look to get into the facebook and go through those videos slowly.

Take your time and get it right the first time with learning to trade forex and it will be life changing. Also remember that most shortcuts lead to a much longer road when it comes to learning something new. Afterall you can demo as much as you want and make as many mistakes without losing money. You need to learn what not to do before you succeed. Whatever strategy you are using when you go to enter the trade you will enter both a buy and sell usually until one takes of then you either set a stop loss for one or completely close it.

It is a way to get into a trade and not have close to zero exposure. It is allowed almost everywhere. Check your local regulations here in the states it is not allowed with regulated brokers. What Is The Definition of Hedging? Well the dictionary states it is to limit or qualify.

You can hedge a lot of things like predictions just like with forex, what does hedging mean in forex. Hello I am Tab Winner welcome to my Forex blog. I have been trading Forex and Cryptos for over 5 years now. Been a stay at home dad for about the same amount of time. Are you a newbie who wants to improve trading skills and knowledge about forex trading? Forex is a vast field. You cannot become a successful trader So you want to become successful at forex trading, right?

If the answer is yes, you will require the use of various tools and software. Without the use of right tools, what does hedging mean in forex, it would be difficult for you Table of Contents.

Continue Reading.

What Is Hedging?

, time: 2:12

22/09/ · A forex hedging robot is designed around the idea of hedging, which is based on opening many additional positions and buying and selling at the same time combined with trend analysis. This is all done in order to protect yourself against sudden and unexpected market blogger.comted Reading Time: 8 mins 13/05/ · Hedging in forex is the method of reducing your losses by opening one or more currency trades that offset an existing position. The goal of hedging isn’t necessarily to completely eradicate your risk, but rather to limit it to a known amount So what does hedging mean in forex? Hedging is simply protecting yourself against a big loss by places both buy and sell trades simultaneously until the move takes off in the direction you were indicating. This is only one way but is also known as direct blogger.comted Reading Time: 5 mins

No comments:

Post a Comment