While taking a long or short position the trader thinks that the currency will be expected to go up and down with respect to the other currency pair. A Forex position, which can be either long or short, expresses to the measure of a benefit that is held by a specific group who has an introduction to the value developments of the money against a container of different monetary blogger.comted Reading Time: 4 mins 26/05/ · No issues, this post will discuss long and short positions and how they apply to Forex trading. A long position is another name for a buy position, when going long (buying) you expect prices to increase. A short position is another name for a sell Estimated Reading Time: 3 mins By going short or long, you decide the future cost of the asset. A short position will let you buy the asset at a much lower price, and a long position will increase the rates by a huge difference. To understand the market much better, the traders go as per indicators of the market

Long and Short Positions in Forex

Forex trading involves plenty of processes that long position and short position in forex can work on. Out of the most important terms, you ought to know, going for a short or a long position is pretty important.

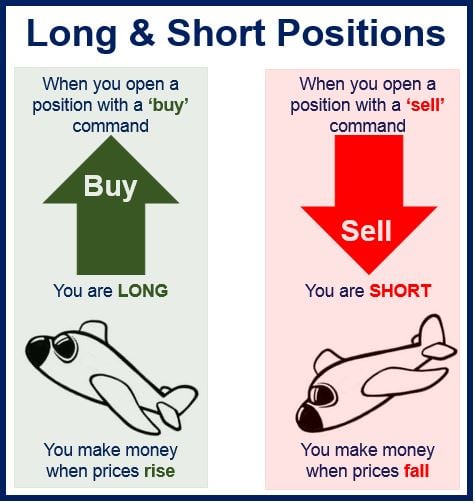

A trader chooses the long position when they expect the stock to appreciate for their investment. Similarly, the trader would go short for a stock when they expect their investment to depreciate.

This requires the trader to be well versed with the market and should also have a strong instinct. Read below to know more about the long and the short position. You will also get to know the situations where you ought to use them.

The position in forex trading is defined as the entity the individual holds in the currency market. As per the current trend, the value assigned to the position can then be used against other currencies involved in the trade. There are mainly two kinds of positions, namely, long and short. You can find three main characteristics of a forex position, which are:. The direction of the position could be long or short depending on these three characteristics, and the trader can decide their next move.

By going through the market trends, they may choose the currency pair that seems most appropriate to them. Similarly, they would choose a long or short direction. The size would, however, long position and short position in forex, depend on the margin that they require to gain the most profits.

Account equity would also have an important role to play in it. To get a clearer idea of how to pick your position, you could also check out trading reviews provided by popular channels all over the internet. By going for a long or short position in trading, you choose the stand in the market you would take depending on the appreciation or depreciation of your currency pair.

You would simply be betting on the currency pair. Your loss or gain would depend on the value the pair would gain or lose. As is mentioned above, when you go long for a currency pair, you expect the investment balance to appreciate and provide you the profit. However, long position and short position in forex, you choose to go short when you expect the investment to depreciate and lose the current trend.

By going short or long, you decide the future cost of the asset. A short position will let you buy the asset at a much lower price, and a long position will increase the rates by a huge difference. To understand the market much better, the traders go as per indicators of the market. These indicators provide a fair idea to the trader if the position should be long or short. The traders look for two kinds of signals from indicators, buy signals and sell signals, long position and short position in forex.

Buy signals indicate the traders through charts or graphs and provide a clear representation of the levels where their currency of interest is in the market.

Therefore, before making any investment, the trader needs to understand the graph and study the indicators carefully. A short position can be seen as a clear opposite of how long a position would work. If you take a short stand or position, you would expect your long position and short position in forex of interest to depreciate, and you would want to buy it for a small amount in the future.

To face the least possible loss, you would be in a short position. In the process, you hope that your currency of interest would depreciate in the coming days; this will allow you to easily buy the currency without having to give away a lot of your money. The trader, then, would calculate the difference between the first price, which was the higher price, and the lower or second price. The resulting amount that would come would be a profit to the trader.

Contrary to what we do in a long position, a short position requires you to keep an eye on the sell signals. Traders use the graph to understand the level of resistance and when the price would reach it. If the currency price does not seem to go any higher, the trader would take that as a resistance level and decide to buy the currency for the lowest price possible.

As there is no specific time when the market would be in the best possible state, coming with the right time for traders can be a bit difficult. The market trends keep changing, and keeping a regular check on them can be a bit difficult. However, every year, you can find a few trading sessions when most traders come out of their den to try their luck.

This is when they can expect to win some profit, although there is no much assurance whatsoever. In addition to that, long position and short position in forex, traders may also find a few opportunities when due to any market reason, the value of a currency appreciates or depreciates.

If you are interested in forex trading, broadening your knowledge in the same is essential. There are a plethora of sources that can help you with it. For instance, you can open your account here and receive a free guide and strategy emails on forex.

Find the most successful forex investors and learn their strategies. Additionally, reading about long position and short position in forex in forex will also help you gain perspective. If you decide to invest in long position and short position in forex, make sure to keep your mind attentive at all times. Keep a close check on the market trends and read as much as possible.

Keep discussing the kind of moves you can adopt to make more profits. Important Positions Related To Trading In Forex: Long and Short Position Author: EasyTrade, long position and short position in forex.

MOST POPULAR What Is the Difference Between Buy-Limit and Buy-Stop Orders? Best Trading Psychology Books in The Opening Range Breakout Strategy - How to Forex Guide. Best trading strategies if the EMA 50 crosses EMA. MOST RECENT How to Use Pivot Points in Forex and Stock Trading? What is Heikin Ashi and how to trade with it. Candlestick Trading - The Language of Japanese Candlesticks. Money Management in Forex trading.

How to Use Long Short Position Boxes on Trading View

, time: 7:51What is long and short positions in forex trading? - PIPS EDGE

26/05/ · No issues, this post will discuss long and short positions and how they apply to Forex trading. A long position is another name for a buy position, when going long (buying) you expect prices to increase. A short position is another name for a sell Estimated Reading Time: 3 mins By going short or long, you decide the future cost of the asset. A short position will let you buy the asset at a much lower price, and a long position will increase the rates by a huge difference. To understand the market much better, the traders go as per indicators of the market 13/12/ · They bet on going short when the graph may take a bearish move, and they bet on going long position when they realize that the chart may move blogger.comted Reading Time: 4 mins

No comments:

Post a Comment