23/09/ · When using the RSI (current/higher timeframe), you know the current value, but you donnot know if there is the market is ranging in the timeframe you are trading in. Eg. at chfjpy - in the 1 hourchart (4H and so on) we have an uptrend If you identify a pair that is ranging in fairly smooth cycles, you can also use our alert systems and indicators like The Forex Heatmap ® to verify your trade entries. In a ranging market you may have to trade slightly more frequently, but ranging cycles on the H4 time frame can last days, so this qualifies as swing trading You can also use these trend indicators to determine if the market is trending, ranging, or choppy using multiple time frame analysis. Traders can also determine what curencies are strong or weak using our forex market analysis spreadsheet, and also to spot support and resistance levels. You will also know when the trends start and end, and on which time frame

How to determine if a market is ranging ?

After a long trending period on the higher time frames, and when the forex market stalls it generally starts to consolidate. This is when oscillations and ranges start to develop. Ranging pairs can have smooth and clear, forex indicator for determining the market environment trending or ranging, trade-able cycles or be ragged and choppy like the sketches and images you see above.

When developing a range trading strategy, in general, traders forex indicator for determining the market environment trending or ranging stay away from the smaller time frames. Now lets discuss specific time frames for range trading the forex market. In general you want to trade ranging and oscillating pairs on the higher time frames, like the H4, D1, and W1 time frames.

In some cases if you are trading a volatile pair, you can also trade cycles and ranges on the H1 time frame as long as the ranges are large enough. We trade 28 currency pairs with our system. Some pairs have lower volatility and some are quite high. If a pair is ranging on the H1 time frame you can review the currency pair characteristics and quickly determine if you should range trade the pair by drilling down the charts with multiple time frames.

Tweet Share in Pin It Reddit. Home About Us Login Subscribe Blog Forex Tips Contact Us Education 35 Lessons Videos Webinars Sitemap. Range Trading Strategy For 28 Forex Pairs. When the forex market is not trending strong up or down, you can use range trading strategies presented in this article to profitably trade the forex market. If you analyze the forex market using multiple time frame analysis, the pairs that are ranging and cycling up and down will be easy to spot, because multiple time frames analysis is so thorough.

If you set up the charts and trend indicators by individual currency, you will be able to detect what currency in the pair is driving the movement and causing the pair to range up and down. Generally speaking a ranging forex market or pair is when one or more pairs are cycling up and down between defined support and resistance levels. The forex market is trending when the larger time frames like the D1, W1, or MN are pointing up or down and in agreement.

A strong trend might be just the D1 and W1 time frame pointing the same way on a pair or group of pairs with one common currency. A ranging market forex indicator for determining the market environment trending or ranging be when pairs, the market as a whole, or a group of pairs are ranging, cycling, or oscillating up and down, a non directional market.

If the ranging pairs have a wide enough range, they can be traded using some of the strategies shown below, forex indicator for determining the market environment trending or ranging. Ranging markets can go on for several days or weeks so learning how to trade trending and ranging markets will increase pip totals. When the market is ranging, at some point, the ranging pairs finally break out of their ranges and start to trend again. Spotting forex pairs that are oscillating or ranging and planning trades for the up and down cycles is fairly easy.

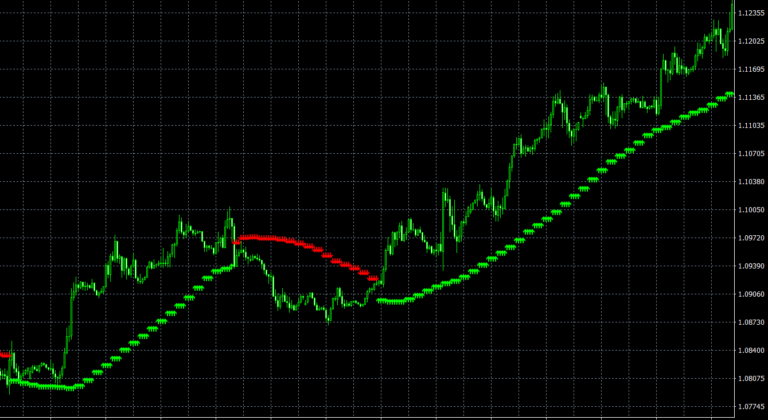

Look at the first example below, if you attach a set of exponential moving averages to the various time frames on your forex charting platform, ranging pairs are easy to spot. This is a ranging currency pair with repeating support and resistance levels reversing up and down off of the same support and resistance levels. Now look at these two examples, these pairs are ranging, but the top pair is ranging with increasing tops and bottoms.

So if this pair is ranging on, for example, the M30 time frame, forex indicator for determining the market environment trending or ranging, the D1 time frame is likely in an uptrend. Now look at this example, this pair is ranging with decreasing tops and bottoms. So if this pair is ranging on, for example, the H4 time frame, the W1 time frame is likely in a downtrend.

Range trading the forex market is more difficult when the market, forex indicator for determining the market environment trending or ranging, or pair you would like to trade is ranging up and down in a choppy, ragged fashion. It is probably best to not trade these up and down cycles, or reduce the number of lots traded significantly. Stay away from any ranging pair that looks like this on the smaller time frames, not worth the risk.

With our trading system, we trade 28 currency pairs. Some pairs are not as volatile as others, so the ranges between the top and bottom of the range cycles amplitude can be different on two different pairs on the same time forex indicator for determining the market environment trending or ranging. Amplitude is just the number of pips between the top and bottom of the oscillations cycles.

This is the pip potential of each cycle to estimate your pip potential for the trade cycle. Knowing this in advance will help you determine if you want to trade this pair, and will also assist with stop placement. If the above illustration is the H4 time frame, how many pips will it move up and down? You can apply this simple filter too all 28 pairs we trade. On the higher time frame ranges and oscillations it could be hundreds or even over pips from top to bottom of the oscillation cycle.

With some experience drilling down the charts you will get to know the 28 pairs and start to better identify the pip potential of each move before you enter. If you move to even higher time frames the pip potential on oscillating pairs is huge and your money management ratio is excellent, even in non-trending markets. The point of entry should be as the new cycle is developing, after the reversal off of support or resistance.

It is also possible to use both groups of pairs to verify the buy trade. Traders can verify entries on pairs in real time with up to 14 pairs using The Forex Heatmap®. Here is a snapshot of of NZD strength on The Forex Heatmap®, a real time visual map of the forex market.

It is highly likely that other NZD or JPY pairs are cycling and ranging also, so check these pairs on the same time frames. One range trading forex indicator for determining the market environment trending or ranging is for traders to set up their trends charts and moving averages so that you can easily spot all of the new cycles.

You can set up all of the NZD pairs together in one group and put all of them on one screen. You can also set up your charts with all of the JPY pairs together on one screen. This will increase your trading confidence substantially when trading ranging pairs or even trending. We have a forex video library that includes short videos on how to set up show you how to set up up our trend charts by individual currency.

This is an example of a ranging pair using our exponential moving averages. The support target area is at the 0. When a pair is oscillating the entry point is when the new cycle is starting, here is the estimated trade entry points on a oscillating pair. Look at the pricing as the range on this pair is pips, tremendous potential. Even though this is a smaller time frame, it is still ranging in about a pip range. Since the range is oly about pips, the traders must decide if this amount of pips meets their criteria for a good money management ratio, forex indicator for determining the market environment trending or ranging.

Ifyou sell this pair as it starts dropping, and you install a 30 pip stop, this would result in a 3 to 1 money management ratio. So a good ratio, but not great. The wider the range the better on range trading. Since the forex market is not always trending, it could be ranging, sometimes for weeks, it makes sense to have a range trading strategy available to capitalize on these non trending periods. With excellent analytical methods like multiple time frame analysis applied to our simple moving averages at our disposal, it should be fairly easy for traders to identify ranging pairs or groups of pairs.

If you identify a pair that is ranging in fairly smooth cycles, you can also use our alert systems and indicators like The Forex Heatmap ® to verify your trade entries. In a ranging market you may have to trade slightly more frequently, but ranging cycles on the H4 time frame can last days, so this qualifies as swing trading. When you combine range trading with trend trading, you can maximize the opportunities to make pips across 28 currency pairs in any market environment.

Conclusions About Range Trading - When the forex market is not trending it is usually oscillating or ranging. Ranging pairs usually range in groups, i. all of the JPY pairs or all of the EUR pairs are ranging at the same time. Ranging pairs can be identified using multiple time frame analysis, buy individual currency.

You can write a trading plan to trade a ranging pair. Trade ranging pairs on the higher time frames, H4 and larger, but occasionally on the H1 time frame, if the ranges are wide enough. Use our trend indicators and The Forex Heatmap ® to verify all trade entries, along with the other components of our trading system. If you combine all of the techniques presented here, you will have the best range trading strategy available for any forex pair or group of pairs.

Trading forex indicator for determining the market environment trending or ranging forex pairs with the strategies presented will increase your pip totals in non trending markets. Press Releases Currency Options Forex Audio Book. Seminars Proven Forex System Referral Program. Copyright © MT2 Enterprises, LLC.

All right reserved.

Introduction to Trend-viewer pro - New multi-time frame trend finding indicator on mt4

, time: 5:56Forex Trend Indicators Free, Easy Setup, 9 Time Frames - Forexearlywarning

22/09/ · i used bb20 and bb market ranging when the upper and lower bb20 is outside upper and lower bb50, and bb50 is flat. with those indicator we can determine the condition of market (ranging and trending) i have been used this system for a half year and the result is You can also use these trend indicators to determine if the market is trending, ranging, or choppy using multiple time frame analysis. Traders can also determine what curencies are strong or weak using our forex market analysis spreadsheet, and also to spot support and resistance levels. You will also know when the trends start and end, and on which time frame 21/01/ · Trend Detector No. 1: ADX. One effective method for determining if the market is trending is by using an Average Directional Index indicator (ADX). This is an indicator with a range of values between 0 and to show if price is trending or simply ranging

No comments:

Post a Comment