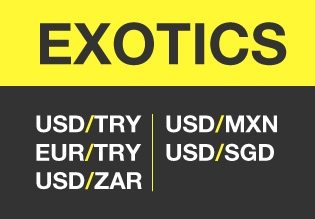

20/03/ · The group of Exotic currency pairs which are characterized by relatively low trading volumes and high spreads includes the least popular instruments available in the Forex market. They consist of currencies which liquidity is almost entirely provided by the main reserve currencies: the U.S. dollar and the Euro. Ticker 15/12/ · Another advantage of Forex exotic pairs is their potential to substantially shift in value. Huge shifts in price are not uncommon for exotic crosses, once a fundamental trend sets in. Along with lower liquidity, there are some other drawbacks with exotic pairs: The bid/offer Estimated Reading Time: 8 mins 31/07/ · Exotic forex pairs are a special type of currency pair that features a primary currency such as the U.S Dollar British Pound, Euro, or Japan Yen alongside a thinly traded currency. The thinly traded currencies are usually made up of currencies from emerging markets such as Turkey, South Africa, Norway, and blogger.comted Reading Time: 6 mins

Exotic Currency Pairs and Why It Is Better to Avoid Them

As we have previously looked at, unlike other markets, currencies are traded as pairs. There are many different currency pairs you can trade from the majors to the exotics. Each Forex pair falls under a different category and in this lesson we look at the different categories of Forex pairs and what the major differences are. You will notice that all of these pairs include that USD.

The reason that the majors are made up of the USD is because of how Forex was historically created and also the amount of trade the USD carries out. USD Forex pairs trade by far and away the most currency of any world currency. Because these pairs are the most heavily traded they will often have forex exotic pairs lowest trading costs and smallest spreads.

This is very similar for cross pairs. Currencies had to be swapped into USD and then converted into the new currency. Then currency cross pairs were created. This allowed traders to trade different cross pairs without the need to involve the USD. These pairs are often known as the wild west of the Forex market.

Because these economies are far smaller, the currencies are traded far less. Why does this matter to you? Because the exotic currency pairs will have the highest trading costs and commissions.

Exotic currency pairs will also often have the most wild swings due to the thinner market liquidity compared to the major or minor pairs. EURO V Polish Zloty. Johnathon is a Forex and Futures trader with over ten years trading experience who also acts as a mentor and coach to thousands and has written for some of the biggest forex exotic pairs and trading sites in the world.

Forex Trading for Beginners. Price Action Trading, forex exotic pairs. Forex Charts. Forex Trading Strategies. Money Management.

Best Forex Trading Platforms. Trading Lessons. com helps individual traders learn how to trade the Forex market. We Introduce people to the world of currency forex exotic pairs. and provide educational content to help them learn how to become profitable traders.

we're also a community of traders that support each other on our daily trading journey. Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer What are the Major, Minor, Cross and Exotic Forex Pairs. What are the Major, Minor, Cross and Exotic Forex Pairs As we have previously looked at, forex exotic pairs, unlike other markets, currencies are traded as pairs.

What forex exotic pairs the Major Forex Pairs? List of Forex Major Pairs. Major Forex Pairs. EURO V US DOLLAR.

BRITISH POUND V US DOLLAR. US DOLLAR V SWISS FRANC. US DOLLAR V JAPANESE YEN. US DOLLAR V CANADIAN DOLLAR. AUSSIE DOLLAR V US DOLLAR. NZ DOLLAR V US DOLLAR. Below is a List of Example Forex Forex exotic pairs and Minor Pairs.

MINOR FOREX PAIR. EURO V BRITISH POUND, forex exotic pairs. EURO V AUSSIE DOLLAR. BRITISH POUND V SWISS FRANC. AUSSIE DOLLAR V NZ DOLLAR. AUSSIE DOLLAR V CANADIAN DOLLAR. AUSSIE DOLLAR V SWISS FRANC. BRITISH POUND V AUSSIE DOLLAR. CROSS Forex Pairs. EURO V JAPANESE YEN. CANADIAN DOLLAR V JAPANESE YEN. BRITISH POUND V JAPANESE YEN. AUSSIE DOLLAR V JAPANESE YEN. SWISS FRANC V JAPANESE YEN. EURO V NZ DOLLAR.

Forex exotic pairs V CANADIAN DOLLAR. Exotic Forex Pairs These pairs are often known as the wild west of the Forex market. Below is a list showing example exotic Forex pairs. EXOTIC Forex Pairs. NZ DOLLAR V SWISS FRANC. SWISS FRANC V SINGAPORE DOLLAR. SWEDISH KRONA V JAPANESE YEN. SINGAPORE DOLLAR V JAPANESE YEN. BRITISH POUND V NORWAY KRONER. About Johnathon Fox Johnathon is a Forex and Futures trader with over ten years trading experience who also acts as a mentor and coach to thousands and has written for some of the biggest finance and trading sites in the world.

Previous Post: « Weekly Price Action Trade Ideas — 22nd to 26th of July. Next Post: Forex Regulation: Regulatory Bodies Controlling Foreign Exchange ». Search this website. Join Us Now! Compare Brokers Best Forex Brokers Forex Demo Accounts Best Forex Trading Platforms Forex Apps Swap Fee Accounts MT4 Brokers.

com helps individual traders learn how to trade the Forex market We Introduce people to the world of currency trading, forex exotic pairs.

we're also a community of traders that support each other on our daily trading journey Finixio Ltd, 2 Ferdinand Place, London, NW1 8EE business finixio.

Trade Forex EXOTIC Pairs \u0026 MASSIVELY Improve Your Profits

, time: 10:27What are the Major, Minor, Cross and Exotic Forex Pairs

The exotic currency pairs also play a valuable role when entering forex trades. When you use the Forexearlywarning trading system, you can prepare a list of rules for forex trade entries. This list of rules includes things like knowing when the scheduled economic news drivers are, the direction of the major trends and support and resistance levels 15/12/ · Another advantage of Forex exotic pairs is their potential to substantially shift in value. Huge shifts in price are not uncommon for exotic crosses, once a fundamental trend sets in. Along with lower liquidity, there are some other drawbacks with exotic pairs: The bid/offer Estimated Reading Time: 8 mins 21/10/ · How Professional Traders Trade the Exotic Currency Pairs. Professional traders don’t trade the exotic currencies through the retail Forex brokers and the currency pairs that the other traders use. They trade through the banks and through a very different blogger.comted Reading Time: 11 mins

No comments:

Post a Comment