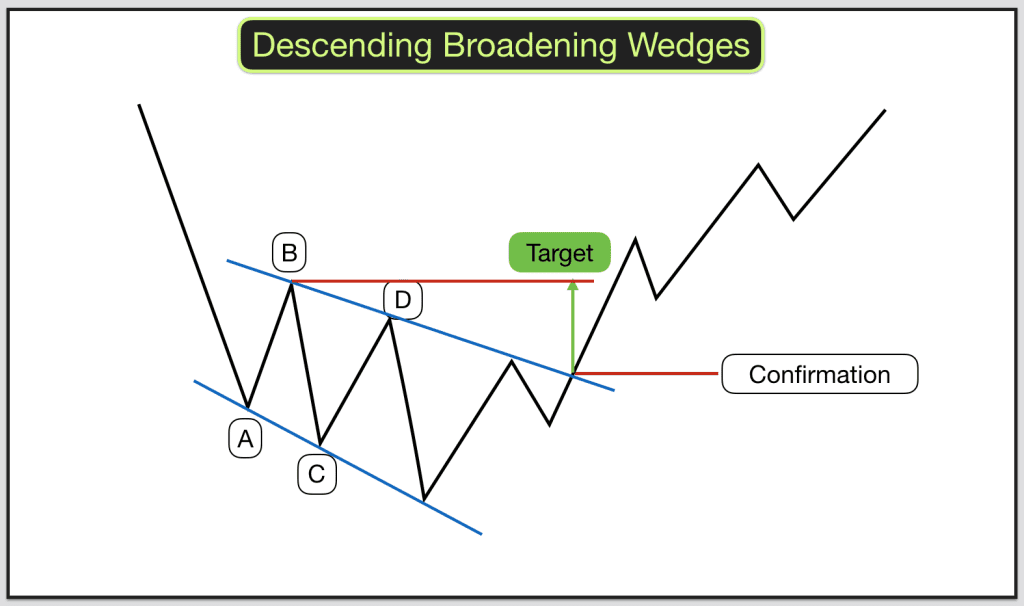

Descending Broadening Wedges tend to breakout upwards. Swing traders can trade the pattern from top to bottom and from bottom to top. After the trendlines are formed, as soon as price touches the upper trendline go short. Cover this short (exit the trade) when price reaches the lower blogger.comted Reading Time: 8 mins A descending broadening wedge is bullish chart pattern (said to be a reversal pattern). It is formed by two diverging bullish lines. A descending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. The upper line is the resistance line; the lower line is the support line 09/03/ · Descending Broadening Wedge. In 60% of cases, a descending broadening wedge’s price objective (green bar) is achieved when the resistance line is broken 40% chance of re-testing support of the channel, which would be long-term support. As we have been rejected off Author: Mcrobbie

Broadening Wedge Patterns - "Megaphones" - Forex Opportunities

These chart patterns are similar to triangleswedgesflags and pennants. Broadening wedges can be either bullish or bearish depending on how they form within an existing trend. There are some clues in the pattern itself that suggest whether the market is likely to continue the same trend or reverse.

They can of course also be traded as breakouts. A broadening wedge forms when the price is holding between two diverging trend lines.

The upper line is resistance and the lower line is support. When the broadening wedge is aligned horizontally, the price makes higher highs at the top and lower lows at the bottom. See Figure 1. Broadening wedge patterns can also be sloping upwards or downwards.

These are known as ascending broadening wedges and descending broadening wedges. It rarely will be, forex descending broadening wedge. Where the activity is will often give a clue as to the break direction. Like other wedge patterns, the broadening wedge can be aligned towards the main trend or against it. The trading rule for broadening wedges depends on the context. The breakout direction when the pattern ends is usually against the direction the wedge is forming but the odds are close see table below.

The ascending broadening wedge generally ends with a bearish breakout. The descending broadening wedge generally leads to a bullish breakout. But both forex descending broadening wedge extend for long periods and this makes timing a breakout harder than with other patterns, forex descending broadening wedge.

The table above shows the percentage of broadening wedges that resulted in either a downward or upwards correction. This data covers a year period of five forex pairs at five different timeframesup to the daily chart. When the pattern is oriented against the trend the price tends to breakout forex descending broadening wedge the same direction as the original trend, forex descending broadening wedge.

These are continuation patterns and are usually quite small relative to the overall trend. These cases are quite similar to pennants, wedge, flags, and triangles.

With range trades, the pattern defines a price channel. You can then trade the price as it moves from the lower support to the upper resistance or vice versa. For example if the broadening wedge is forming over a few weeks, this gives plenty of opportunity for swing trades between the highs and lows in which the pattern is developing. The example in Figure 2 shows forex descending broadening wedge ascending broadening wedge on chart GBPUSD H4 and shows the characteristic megaphone shape.

This case hints at a bearish continuation of the trend. eBook value set for the classic trading strategies: Grid trading, scalping and carry forex descending broadening wedge. All ebooks contain worked examples with clear explanations. Learn to avoid the pitfalls that most new traders fall into. The price finally breaks to the downside. This is shown in the shaded circle, forex descending broadening wedge.

Notice that the breakout is sudden once the price breaks below the lower support line of the wedge. When trading wedges, the size of the pattern itself provides the best guide to the placement of stop losses and profit targets. In the example shown in Figure 2, the lowest point of the pattern is the target level for the breakout. This is shown by the horizontal orange line. The price easily crosses this line and the breakout moves further down before retracing some of the fall.

When following a breakout such as this, the stop loss can be placed between the lower support and the mid line of the pattern. Short positions are closed if the price moves up above these levels, forex descending broadening wedge.

Start here Strategies Technical Learning Downloads. Cart Login Join. Home Technical Analysis. A broadening wedge is a range where the price is holding between two trend lines that are moving apart. Figure 1: Broadening wedge - megaphone © forexop.

Copyright © forexop. Figure 2: Ascending broadening wedge © forexop. Naked Trading — Declutter Your Charts An abundance of complicated chart indicators, studies and other tools has led some people to question The Descending Broadening Wedge The descending broadening wedge is easily spotted on a chart.

It looks like a megaphone with a downwards Ascending Broadening Wedge Patterns The ascending broadening wedge is a chart pattern that can be traded in several ways; either as a bullish Interpreting Price Channels and Forex descending broadening wedge Both rectangles and price channels appear in virtually all forex charts. Price channels can provide Are Confluence Zones Useful in Forex?

Crossing support and resistance lines meet at so called convergences or confluent areas. Is there anything No Comments. Leave a Reply Cancel reply. Leave this field empty. Contact Us Timeline FAQ Privacy Policy Terms of Use Home.

Descending Broadening Wedge Tutorial - How to identify a Chart Pattern - Advance Price Action -

, time: 3:11The Descending Broadening Wedge - Forex Opportunities

09/03/ · Descending Broadening Wedge. In 60% of cases, a descending broadening wedge’s price objective (green bar) is achieved when the resistance line is broken 40% chance of re-testing support of the channel, which would be long-term support. As we have been rejected off Author: Mcrobbie 28/08/ · A descending broadening wedge is bullish chart pattern (said to be a reversal pattern). It is formed by two diverging bullish lines. A descending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. The upper line is the resistance line; the lower line is the support line. Each of these lines must have been touched at least twice to validate the blogger.comted Reading Time: 3 mins Right-angled broadening wedges. The ascending broadening wedge consists of an upward sloping resistance line and a horizontal support line, and the opposite for the descending broadening wedge. The lines are drawn with a minimum of two contact points per line. Volumes tend to increase during the formation of the pattern and are at their maximum

No comments:

Post a Comment