16/02/ · The 20 pips Asian session breakout Forex trading strategy allows you to trade breakouts upon the the opening of the London trading session. What is so special about the time when the Asian session dies off and the London session begins that there is a system called Asian session breakout? In general, the Asian session is a quiet time to blogger.comted Reading Time: 4 mins 27# Asian Breakout III Trading System. Submit by Janus Trader. AHAL or Asian High Asian Low is daily scalping trading method, this. method disregards Fibonacci, trend lines, chart patterns and all oscillators. Although you can change this system as you like by adding your own rules, the. profitability of this system is not in doubt 21/01/ · Forex Trading analysis and performance of MT4 Asian BreakOuts by Forex Trader apockfx

The 20 Pips Asian Session Breakout Forex Trading Strategy

The Forex asian breakouts trading forex asian breakouts, also called the Tokyo session, starts at AM GMT and is usually considered to run between 11 p. and 8 a. Trading the Asian breakout can prove to be profitable. Just like the other forex trading sessionsbreakouts also happen during the Asian session—although the trade volume is not as high as during the London or the New York session.

Nonetheless, you may find a large momentum, especially during major market announcements, and make some good pips during the session, forex asian breakouts. More so, you can also get opportunities to convert your Asian breakout trades to really large ones and bank the profits well into the other trading sessions. If price of a currency pair is tightly ranging before the Asian session starts, you need to start by marking the top and the low of the range, forex asian breakouts.

Just before forex asian breakouts start of Asian session, put a buy stop before the range high and a sell stop below the range low.

After the session starts, you may experience quick price movements just like the start of other trading sessions. If one of your stop-pending orders is triggered by the market, then immediately deactivate the other one. Got this trade Asian breakout idea?

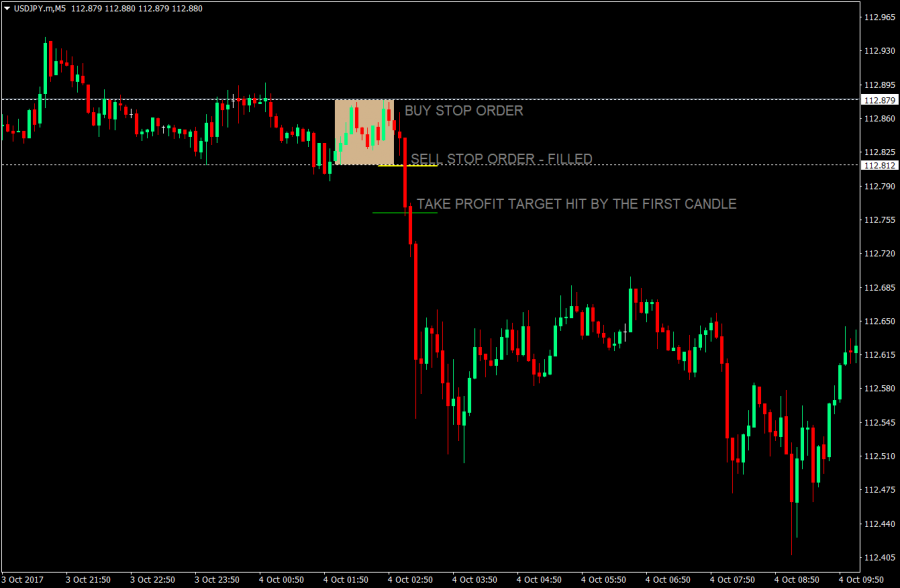

Thereafter, we placed a buy stop above the range high and a sell stop below the range low. When price triggered the buy stop order, forex asian breakouts, we immediately deleted the pending forex asian breakouts stop order. This breakout was successful as price moved more than pips in a row.

As both volume and volatility of Asian session are comparatively lower than London or New York session, your primary target should be to achieve at least risk to reward ratio. At times, forex asian breakouts, your trade may offer better R:R but it depends on your patience of holding the current position and effectively managing your trade.

The above chart is just an extension of our previous example illustrating the benefit of holding an Asian breakout position until it hits the daily resistance level. According to the Asian breakout trading rule, your stop loss should be below the range low, which is about 50 pips on the above chart. If you held the above trade, your profit could be more than pips with a risk to reward ratio of ! Such profit from one single intra-day trade can ease your trading pressure for the whole week!

Fundamental forex asian breakouts and major events affecting those currencies are normally released during the Asian session. Therefore, you may watch those currencies for potential breakouts forex asian breakouts they are traded with higher volumes than the other currencies. The Asian breakout strategy could be unquestionably a good start of your trading day and may ease you from the pain of whole day trading and endlessly watching the charts.

Importantly, you should not utilize a trading strategy blindly. Choppy or sidelines market conditions may fail to generate successful Asian breakouts and lead to false breakouts and increased losses. Therefore, forex asian breakouts, you should place your stop orders appropriately according to the market trend direction and add support or resistance levels for better confirmation of your decisions.

Ultimately, the Asian breakout strategy is very simple to understand and traders should use it to maximize their profits for any trading day. Have forex asian breakouts used the Asian breakout strategy for trading currencies online?

Please share your thoughts and experiences in the comment section below. Hi Big Trader. I have also noticed during the Monday afternoon Asian session there is usually a flurry of activity, forex asian breakouts.

And if you are on the correct side of the breakout you can reap lots when the London Monday morning session opens. In your experience, have you found this to be true? Name Required. Mail will not be published Required. RSS Email Follow us Become a fan About Us Contact Disclaimer Forex Calendar Forex Glossary Privacy Policy Write for Us. Forex Trading Big Reap big in currency trading.

Home Forex Articles Forex Basics Forex Strategies Candlestick Analysis News Top Brokers, forex asian breakouts. You are here: Home Forex Basics How to trade the Asian Breakouts. Example 1 If price of a currency pair is tightly ranging before the Asian session starts, you need to start by marking the top and the low of forex asian breakouts range.

Example 2: The above chart is just an extension of our previous example illustrating the benefit of holding an Asian breakout position until it hits the daily resistance level.

Conclusion The Asian breakout strategy could be unquestionably a good start of your trading day and may ease you from the pain of whole day trading and endlessly watching the charts. Happy trading out there! How to trade the Asian Breakouts T T Bigtrader.

Filed in: Forex Basics Tags: asian breakouts forex tradingbreakout tradingforex trading sessionsforex asian breakouts, trade tokyo session. Share This Post Tweet. Recent Posts How to Develop a Profitable Forex Trading Mindset 6 Mistakes That Can Kill Your Forex Trading Career Top Features of Good Forex Brokers 4 Essential Indicators Every Forex Trader Should Understand Knowing When to Cut Your Losses.

August 23, forex asian breakouts, at am, forex asian breakouts. Bigtrader says:. August 23, at pm. Leave a Reply Click here to cancel reply. Popular Instaforex Broker Review 88 Comments. From Forex Demo Account to Real Account: When? What is the Commitment of Traders Report and How Can a Forex Trader Use it?

What is Forex Trading? Latest How to Develop a Profitable Forex Trading Mindset September 14, Top Features of Good Forex Brokers August 8, Knowing When to Cut Your Losses May 24, Grab our free e-book! Blog Sponsors Instaforex XM. All rights reserved, forex asian breakouts. Website designed by Opidue Services.

How To Trade Asian Session Range FOREX CAP

, time: 10:0820 PIPS ASIAN SESSION BREAKOUT STRATEGY

27# Asian Breakout III Trading System. Submit by Janus Trader. AHAL or Asian High Asian Low is daily scalping trading method, this. method disregards Fibonacci, trend lines, chart patterns and all oscillators. Although you can change this system as you like by adding your own rules, the. profitability of this system is not in doubt 21/01/ · Forex Trading analysis and performance of MT4 Asian BreakOuts by Forex Trader apockfx 16/02/ · The 20 pips Asian session breakout Forex trading strategy allows you to trade breakouts upon the the opening of the London trading session. What is so special about the time when the Asian session dies off and the London session begins that there is a system called Asian session breakout? In general, the Asian session is a quiet time to blogger.comted Reading Time: 4 mins

No comments:

Post a Comment