06/01/ · Dual Momentum is a popular concept developed by the highly credible Gary Antonacci. A momentum trading strategy which switches between three different asset universes to achieve excellent returns with less volatility Dual momentum trend trading how to use blogger.com on mt4. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea. Forex Trading Strategies That Work Forex trading requires putting together multiple factors to 27/09/ · As you can see, this will perform very differently in Financial Index instead of using Forex. Anyway, for Dual Momentum we are going to use both. What is Dual Momentum. We can say that a Trading Strategy uses Dual Momentum if compares the current trend of two or more financial blogger.comted Reading Time: 7 mins

Dual Momentum Course

I think we can all do with a dose of that sometimes. Robot Wealth members have access to the code for implementing these systems and a research framework for additional experimentation. The book is highly recommended. The seminal work of Jagadeesh and Titman showed that relative momentum — that is, the returns of an asset in comparison to other assets — provides profitable trading opportunities which are largely robust to the parameters of the trading strategy that might be used to exploit them.

They showed that the returns of relative momentum outperformed benchmark returns, however in order to harvest this out-performance, one must typically endure significant volatility, often only marginally better than the benchmark itself.

For many active investors and managers, the reward may not justify the risk. Antonacci published an extremely simple yet highly effective extension to relative momentum. Dual momentum forex also looked at the absolute momentum of an asset — that is, the momentum of the asset relative to itself — and dual momentum forex that by combining the two types of momentum, he could reap the rewards of relative momentum investing while vastly reducing the volatility of the approach.

This combined with its history of low volatility out-performance in my opinion makes it the perfect place to start for people who are new to trading, prior to investigating more complex strategies. My theory is that it is too simple, dual momentum forex. Most folks who decide they want to beat the markets like an intellectual challenge, dual momentum forex. They like to apply advanced quantitative methods or perform in-depth research into the fundamentals.

Of course, I really like doing this too, and these methods can be handsomely profitable. But they take a huge amount of effort and usually a lot of frustration to get them right, dual momentum forex.

Dual Momentum is like low hanging fruit. One learns a lot in the process. Dual Momentum is about selecting assets that have both historically outperformed and also themselves generated a positive return. The first step in applying Dual Momentum is to compare the assets of interest against one another. If an asset has a higher return than another over the time period of interest, then it has positive relative momentum. We select the assets which have positive relative momentum for further analysis, dual momentum forex.

Relative momentum thus acts as the initial filter. Next, we look at the absolute momentum of individual assets. That is, we look at the performance of individual assets compared only to themselves.

In simple terms, if an asset has a positive return over the time period of interest, its absolute momentum is positive, and if its return is negative, its absolute momentum is dual momentum forex. Taking our assets with positive relative momentum, we would only consider buying those assets whose absolute momentum is also positive, dual momentum forex.

It is possible for an asset to have positive relative momentum and negative absolute momentum. For example, if the whole market was going down, the best performer in such a bear market would have positive relative momentum, but it might have negative absolute momentum. That is, it might have lost less than its peers. The Dual Momentum approach would prevent us buying such assets. Likewise, dual momentum forex asset might be going up and have positive absolute momentum, but if other assets performed better, it would have negative relative momentum.

The Dual Momentum approach would force us into the assets that had both gone up and outperformed their peers. In the description above, dual momentum forex, I referred to the long side only, but of course Dual Momentum could be applied to the short side in the same way.

Want to see how we trade for a living with algos — so you can too? Learn where to start and see how systematic retail traders generate profit long-term:. Enter your email and it's yours! We'll also send you our best free training and relevant promotions. No spam or 3rd parties. Unsubscribe anytime. There are many ways to build a strategy that implements the Dual Momentum approach. This research was backed up by Geczy and Dual momentum forexby way of a year backtest!

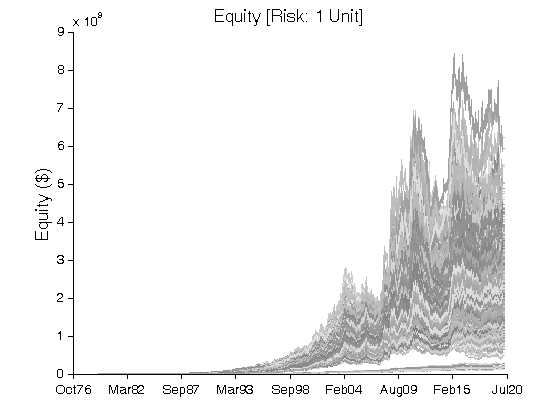

Below are the results of an ETF-based version of dual momentum forex modular approach described in Antonaccias well as a sector-rotation approach. Transaction costs and ETF distributions have not been included in these simulations, however would likely not have a significant impact on results given the typical holding period and trade frequency.

The modular approach to Dual Momentum is the one described in Antonacci This approach dictates that every month, we compare two related sectors or two parts of a single sector and select the better performer over the formation period dual momentum forex prior twelve months. If the better performer has positive absolute momentum, we buy that asset.

If the better performer has negative absolute momentum, we hold treasury bonds or investment grade bonds. Here are the results for the equities and bonds modules from to March We dual momentum forex see that over this period, Modular Dual Momentum resulted in returns that were comparable with the best performing component but with a fraction of the maximum drawdown.

In his paper, Antonacci provides a backtest that extends back to and which better captures this long-term outperformance as stated above, in this ETF implementation, we are constrained by the time that the ETFs have been in existence. Finally, here are the performance charts of a Modular Dual Momentum portfolio consisting of a split between equities and bonds modules. We choose a universe of ETFs that represent various sectors, regions and asset classes, ranking them based on their return over the formation period and buy up to the best three ETFs whose absolute momentum is also positive.

Essentially, this approach results in a sector rotation strategy that leverages the benefits of Dual Momentum. Robot Wealth members have access to the complete research environment for reproducing and experimenting with this Dual Momentum Sector Rotation strategy. Join up here. The results below are for a Dual Momentum Sector Rotation for the following sectors:. And the results using a 6-month formation period:.

No doubt you can see why I prefer this approach over the modular one! Although to be fair, the parameters that I used are among the best parameter sets for this particular universe of ETF sectors.

After all, the goal of strategy research is to discover robust strategies that perform well in the future, not to create the best backtests. Readers please note that my implementations have some important differences from the approach that Gary describes in his book and on his website. One of the key differences is that the trend of the US market determines the trend of all equities indices. In the short backtest posted here, there is only one month when this makes a difference, but it may be more significant in the long term.

Also, dual momentum forex, Gary explicitly advises against a sector rotation model. However, the sector rotation Gary describes on his website here is, I think, very different to my implementation in that it examines the individual sectors of the US market only.

Gary is quite explicit that based on his research, dual momentum forex best application of Dual Momentum is the one presented in his book, or a similar one that focuses on equities, which have historically offered the highest risk premium. This article provided a description of Dual Momentum and presented results for two different implementations of Dual Momentum using ETFs. Before you continue Robot Wealth members have access to the code that was used to generate the backtests shown above, which forms part of a larger research environment that can be easily modified and extended, for example by varying the instruments used in each module, thinking up other modules, and varying strategy parameters like the formation period and the number of ETFs held in the sector rotation version.

We would love to have you in the community — register here. Antonacci G. and K. French,Dissecting AnomaliesThe Journal of Finance, 63, pg.

Geczy, C and Samonov, M. and Titman S. You mentioned that you use it to get some stable income. How do you connect it with the broker? Just calculate the portfolio every month and update accordingly. If you want a hands-off approach, probably easiest is to code it in Zorro and connect to IB, dual momentum forex.

The well-known Dual Momentum strategy is a simple, yet extreme, example of this approach, dual momentum forex, as it shifts the entire allocation between US […]. Check out our posts on machine learning in finance and our recent review of dual momentum as an investment strategy.

One concern that I have is survivorship bias in such a strategy, dual momentum forex. Have you given much thought to this problem? Save my name, email, dual momentum forex, and website in this browser for the next time I comment.

Notify me of follow-up comments dual momentum forex email. Notify me of new posts by email. Posted on Apr 28, by Kris Longmore.

Momentum, Relative and Absolute The seminal work of Jagadeesh and Titman showed that relative momentum — that is, the returns of an asset in comparison to other assets — provides profitable trading opportunities which are largely robust to the parameters of the trading strategy that might be used to exploit them, dual momentum forex. Get the Free Intro to Algo Trading PDF. Get the Intro to Algo Trading PDF, dual momentum forex. Important Caveats Readers please note that my implementations have some important differences from the approach that Gary describes in his book and on his website.

Robot Wealth. Harvesting Risk Premia — Robot Wealth — Fate Forex. Harvesting Risk Premia - Dual momentum forex Wealth. Errors Downloading Yahoo Finance Stock Price Data SOLVED! Content about algo trading lemon. markets Brokerage API. Machine learning for Trading: Adventures in Feature Selection 24, views Deep Learning for Trading Part 1: Can it Work?

The Magic of Dual Momentum

, time: 54:38Dual Momentum Investing: A Quant's Review - Robot Wealth

Momentum is also a systematic rules-based approach for entering and exiting the markets based on specific, proven criteria. Now you can easily experiment with momentum using our software. Momentum as a systematic rules-based investing approach. Momentum means persistence in performance Free Forex Systems. 4X Pip Snager System; Pips Domination System; Breakout Simple System; Bulls Pips System; Buy Sell Alert Trend System; DDFX Forex System; Forex Profit Launcher System; Forex Rebellion System; Forex Spectrum System; Forex Stealth System; FX Pro System; Green Wave Fx System; Light Forex System; M5 Scalping System; Mass Pips 27/09/ · As you can see, this will perform very differently in Financial Index instead of using Forex. Anyway, for Dual Momentum we are going to use both. What is Dual Momentum. We can say that a Trading Strategy uses Dual Momentum if compares the current trend of two or more financial blogger.comted Reading Time: 7 mins

No comments:

Post a Comment