Plus account leverage ranges based on the instrument traded ranging from leverage for crypto including bitcoin, for commodities ( for gold) to for forex with each Plus instrument traded having specific leverage that cannot be changed Leverage: In this field traders just need to input their current leverage, offered by their broker, or they can choose from a range of to a maximum of to simulate the amount of margin used to open a position with different leverage options 6. · Leverage: Regulation: FSA (Saint Vincent and the Grenadines), CySEC 50% Deposit Bonus, Real contest 1st prize Luxury car BMW X5 M, Copy trading, Trade&Win/5

Leverage Forex Trading Brokers

If you want to be a successful online trader, then you have to understand the global markets and know the basics of trading. One of the first things every beginner needs forex 500 leverage learn about is leverage — what this is and how it can be used to maximize profits. Furthermore, Forex brokers offer leverage forex 500 leverage from to or even more sometimes and traders need to decide what leverage is suitable for them. Leverage is an extremely important part of every successful trading strategy.

In Forex, investors apply it to increase the potential profits from fluctuations in exchange rates between any two currencies. It represents something like a loan, a line of credit brokers extend to their clients for trading on the foreign exchange market.

The first thing they need to do is to open an account with a trustworthy brokerage firm and then choose the level of leverage they want to use. This is why forex 500 leverage need to carefully adjust their strategy and apply some risk management techniques.

Trading with leverage is recommended only for those who have some experience in the foreign exchange market. Novices should be warned that if they try to apply it, they are likely to lose their entire account balance — probably in a matter of seconds.

Before looking into leveraged trading products such as CFDs or Forex pairs, we need to better understand how leverage works and how it is applied.

The idea is that the future profits of this investment will be much higher than the borrowing cost. Financial leverage could be used by firms, banks, and individuals and although the specifics may differ significantly, the basics are pretty much the same.

Investment funds, for instance, may leverage their assets by funding a portion of their portfolios with fresh capital resulting from the sale of other assets.

Businesses may also leverage their investments by borrowing funds so they can use less equity their own capital. Another example is purchasing a home and financing a portion of the price with mortgage debt.

Once we have described the basic concept of using leverage, we should be able to apply it in currency trading, as well, forex 500 leverage. As demonstrated above, the purpose of leverage is to give the investor more buying forex 500 leverage to make more gains with limited equity. The same applies to Forex trading, as well. Brokers offer their clients leverage so that they can generate higher profits with only a portion of the transaction value. But how exactly does leverage forex 500 leverage in Forex trading?

These two refer to the same thing — the broker allows the trader to open a position worth times his capital. However, there are several additional things Forex traders should be aware of forex 500 leverage using leverage. One of them is the margin requirement set by the broker. In order to provide leverage to their clients, Forex brokers require a certain amount of funds to forex 500 leverage deposited in the trading account as collateral to cover the risk associated with taking leverage.

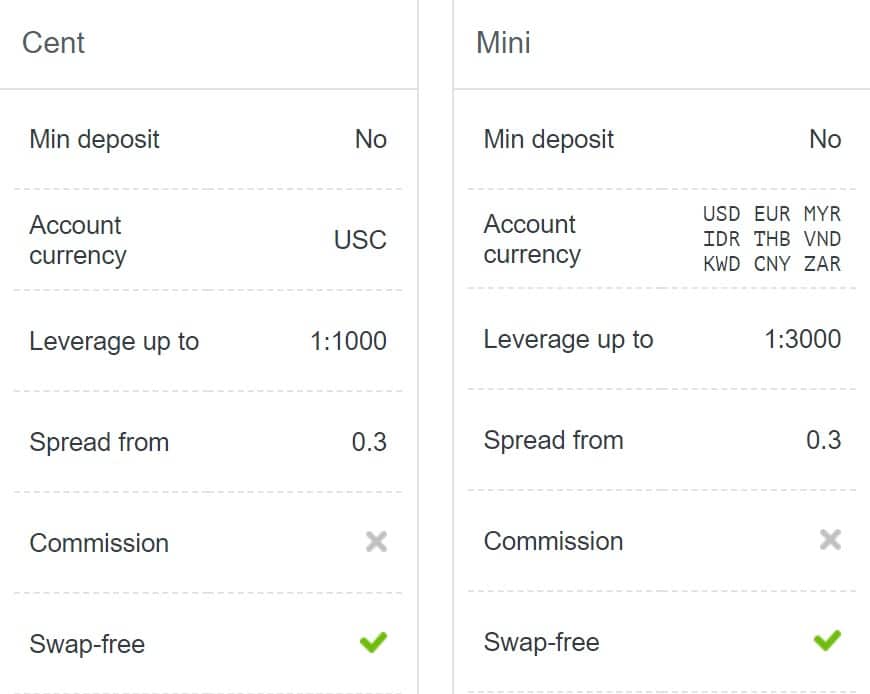

This deposit is called margin and leveraged trading is sometimes referred to as trading on margin. Each broker has a different margin requirement, based on the type of account standard, mini, professional, etc. The initial margin requirement is usually displayed as a percentage of the total transaction value and it could be 0.

There are various formulas for margin and leverage that could clearly show how these two fundamental concepts are linked. For instance, we can calculate the margin by dividing the value of the transaction by the leverage. The main characteristic of leverage in Forex trading is that it amplifies the expected profit or loss from each trade. This means that traders can earn a lot more from a successful transaction with leverage than they would if they invested only their own equity.

Usually, forex 500 leverage, the forex 500 leverage for this major currency pair does not move by more than pips per day 1 pip is one-hundredth of one percent or in this case, the fourth decimal place in the bid-ask price, forex 500 leverage.

This does not sound like a lot — it is a movement of only a fraction of a cent. Note that we have kept this position open only for a few hours and the price movement was very slight.

In other words, we have doubled our equity. When determining what leverage to use, traders should take several important things into consideration. This includes major Forex markets such as the US, Japan, and the European Union where brokers are required to restrict the leverage offered to retail clients, forex 500 leverage. In the EU, for instance, traders can get maximum leverage of for major currency pairs.

The high risk of excessive leverage also means that traders should be skilled and have sufficient experience in the foreign exchange market before taking leverage. Another thing they should consider is the strategy they are about to apply and their overall trading style.

More importantly, forex 500 leverage, it is essential to determine all conditions of the trade before opening a position and this involves its duration, forex 500 leverage. Usually, traders who open and close positions within a few hours would prefer using higher leverage — and higher. This way they can squeeze the highest possible profits out of short-term transactions. Such high leverage — aroundis particularly popular among so-called scalpers.

Scalping is quite an interesting strategy in Forex trading where positions are kept open only for a few minutes or even seconds. Until a few years ago, the Forex market became extremely popular among retail traders and one of the reasons for this was the opportunity to get high leverage and make the most of your limited capital. Nowadays, you would not find many brokers offering leverage due to regulatory changes aiming at creating a more secure and sustainable trading environment.

Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, forex 500 leverage be precise.

Of course, traders should know that although leverage works as borrowed capital, i. as a line of credit as some would say, it has no additional cost. Traders do not have to pay interest on the leverage they get. There is no need to repay any debt or pay for anything else — the forex 500 leverage cost for the transaction will be clearly displayed by the broker beforehand. Last, but not least, traders should understand that in most cases, forex 500 leverage, leveraged trading is the only way for them to access the foreign exchange market.

Typically, transaction volumes here are within the six and seven-figure rate and only a handful of retail traders could afford to open trades with their own equity. When using leverage, however, everyone can trade against leading banks, hedge funds, and other institutional traders.

Leveraged trading is always linked with great opportunities for profits and high risks. While leverage is used with the purpose to magnify the profit from a trade, it may also magnify the negative outcomes from unsuccessful trading — i. the financial losses. This is one of the most underestimated dangers to beginner traders — they would get leverage tempted by the attractive promise for huge profits but without a solid, forex 500 leverage, reliable strategy and good knowledge of the market, they risk losing all their capital within days or even hours.

To avoid losses, they should first learn how to apply leverage and determine how forex 500 leverage leverage would be suitable to them.

In addition, forex 500 leverage, they should apply different risk management techniques and tools — many of these are readily available once you open a retail client account with an online Forex broker. Great risk and management tools are stop losses, for example, but to be effective, they need to be placed correctly by the trader.

Skip to content Home » Forex Brokers » Leverage Forex Brokers. Best Forex Brokers for Korea, Republic of. Fusion Markets Lowest trading costs. Lot Size. Ava Trade. XM Group. Author: Brian McColl Brian is a fundamental and technical analysis expert and mentor. Brian has been a part of the Forex and stock markets for more than ten years as a freelancing trader.

com is a financial media specialized in providing daily news and education covering Forex, equities and commodities. Our academies for traders cover ForexPrice Action and Social Trading. How to Open Forex Account Real Money Forex Account How To Save Yourself From Forex Scam Demo Forex Account What Is Managed Forex Account Leverage Forex Brokers.

Understanding Forex Leverage - What does Leverage do to your Account

, time: 6:37High Leverage Forex Brokers �� (Best from to )

The Best Forex Broker with High Leverage in FP Markets (blogger.com) is TrustedBrokers' Best Forex Broker With High Leverage in Leverage up to across 60+ currency pairs. FP Markets supports all trading styles and Expert Advisors, including scalpers and trading robotos Plus account leverage ranges based on the instrument traded ranging from leverage for crypto including bitcoin, for commodities ( for gold) to for forex with each Plus instrument traded having specific leverage that cannot be changed 6. · Leverage: Regulation: FSA (Saint Vincent and the Grenadines), CySEC 50% Deposit Bonus, Real contest 1st prize Luxury car BMW X5 M, Copy trading, Trade&Win/5

No comments:

Post a Comment