05/03/ · O padrão de velas Three Black Crows (TBC) é um sinal de alerta sobre a próxima tendência de baixa no Forex. Geralmente aparece após uma tendência de alta e consiste em três velas vermelhas de baixa em uma fileira. O que é um padrão de castiçal Three Black Crows no Forex?4,7/5(3) 12/03/ · The Three Black Crows usually indicate a weakness in an established uptrend and the potential emergence of a downtrend. In the book, Japanese Candlestick Charting Techniques, author Steve Nison says “The three black crows would likely be useful for longer-term traders.”Estimated Reading Time: 1 min Three black crows are a visual pattern, meaning that there are no particular calculations to worry about when identifying this indicator. The three black crows pattern occurs when bears overtake the bulls during three consecutive trading sessions

Three Black Crows

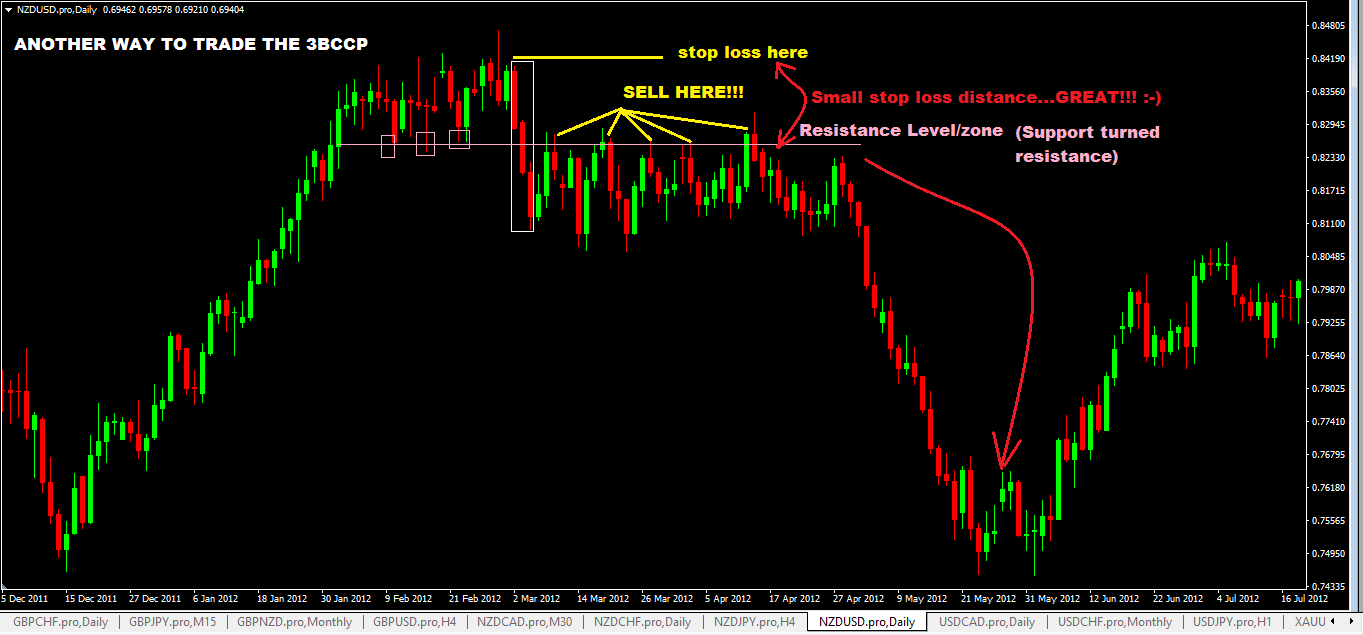

The three black crows is a bearish sign that an uptrend has reversed or is in the process forex 3 black crows reversing. Forex 3 black crows appears in trend tops as well as in bear rallies. That said, forex 3 black crows, trading the pattern when it appears in bear rallies is often easier and less risky than trying to time the turning point of a major trend.

The pattern is identified as three black candlesticks in a row with each having descending open and close prices. That means for a valid signal, the open price of each candlestick should be lower than the last open and the close should be lower than the close of the last. As well the pattern should appear at or near a chart top so that the first bar makes a recent high.

In a bearish trend the pattern will often appear in short upswings or bearish rallies. With forex charts as with other round-the-clock markets the close of one bar will usually level at the open of the next bar unless the bars are split over a weekend or holiday. With stock charts there can be large gaps between the opens and closes where the market has closed overnight or over a weekend for example.

Download the candlestick detector. The shooting star candle makes a new recent high and this implies a short-term top could be forming. The three-black-crows pattern then follows as the price begins to fall. We then see the bearish trend resume after the patterns complete. But since there are other confirming reasons, such as the shooting star, and the established downtrend we can consider those as well.

With the presense of a fourth candlestick which is bullish, the three black crows can extend into a bearish three line strike. The text book description of this pattern is when it indicates the turning of a bullish rally. In these setups we often look for other flags to confirm that a trend may be turning, and the three black crows can be just one of them.

We see a steep upwards move and this is immediately followed by a bearish correction. The forex 3 black crows is already looking overbought at this time. This is the point that the first bearish pattern appears. As with most trends we forex 3 black crows a rise in volatility as the market absorbs the new price levels and the direction is unclear.

After the pause, forex 3 black crows, the market then rallies again and a second, higher peak starts to develop. At this point a bearish reversal looks to be the most likely course of the market. The trend does in fact start to turn downwards.

In hindsight we can see that the top of the chart is forming into a head and shoulder pattern — a characteristic bearish reversal. One of the main problems with reversal signals is handling situations where the market pulls back in the other direction. That happens in cases where a false trend top forms but the market starts to rally up again immediately afterwards.

That means we have to prepare for some increased volatility when entering the market at tops by placing appropriate stop losses. Tight stop losses can be set to close the position on all but the smallest pullbacks. But the disadvantage with that is that it can often mean missing out on larger profits if the market does fall more significantly afterwards.

For an example of that take a look at the chart in Figure 4. There are a few ways to reduce this risk. The easiest is to split the order into several smaller trades a grid and only pyramid up the position if the market moves in the expected direction, forex 3 black crows.

Price action trading forex 3 black crows candlesticks gives a straightforward explanation of the subject by example. It includes data insights showing the performance of each candlestick strategy by market, and timeframe. Hey, I have a MT4 template that I think uses this same strategy. It gives more of reversal trends when 3 crows happen, forex 3 black crows. I did not know how that worked and I figured it was the same strategy. Thanks for sharing it.

Start here Strategies Technical Learning Downloads. Cart Login Join. Home Technical Analysis Candlesticks, forex 3 black crows. How to Identify Three Black Crows The pattern is identified as three black candlesticks in a row with each having descending open and close prices. Figure 1: Three black crows chart formation © forexop.

Figure 4: Handling pullback cases © forexop. Spinning Top Candlestick Pattern A spinning top is a Japanese candlestick pattern that denotes indecision in the market, usually at the High Wave Candlestick Pattern A high wave candlestick is considered a price reversal but is not associated with a specific direction Advance Block Candlestick Pattern The advance block is a three bar pattern that is usually taken as a bearish reversal signal. The pattern Naked Trading — Declutter Your Charts An abundance of complicated chart indicators, studies and other tools has led some people to question Forex 3 black crows Line Strike A three line strike is a continuation group of candlesticks that has three in the direction of a trend Market Blow Offs: How to Identify and Profit from Bubbles and Crashes Bubbles and blow offs produce winners and losers.

The winners are those who get in early or those who Forex 3 black crows a Reply Cancel reply. Leave this field empty. Contact Us Timeline FAQ Privacy Policy Terms of Use Home.

Three Black Crows: Bearish Reversal Pattern? ������

, time: 13:26Como Usar o Padrão de Castiçal Three Black Crows no Forex

05/03/ · O padrão de velas Three Black Crows (TBC) é um sinal de alerta sobre a próxima tendência de baixa no Forex. Geralmente aparece após uma tendência de alta e consiste em três velas vermelhas de baixa em uma fileira. O que é um padrão de castiçal Three Black Crows no Forex?4,7/5(3) 12/03/ · The Three Black Crows usually indicate a weakness in an established uptrend and the potential emergence of a downtrend. In the book, Japanese Candlestick Charting Techniques, author Steve Nison says “The three black crows would likely be useful for longer-term traders.”Estimated Reading Time: 1 min Three black crows are a visual pattern, meaning that there are no particular calculations to worry about when identifying this indicator. The three black crows pattern occurs when bears overtake the bulls during three consecutive trading sessions

No comments:

Post a Comment